Buckle up your seatbelts and get ready for a wild ride through the twists and turns of Bosley’s Driving School saga! Meet Mr. Bosley, the daring entrepreneur behind this driving school extravaganza, with locations in the charming towns of Donaldsonville and Gonzales, Louisiana. Now, picture this: Mr. Bosley is on a mission to teach the art of driving, but not just any driving – he dreams of offering the elusive 38-hour driver’s education course. But, oh, the drama unfolds when his dreams clash with the stern rules and regulations of the Louisiana driver’s education system. Despite a denial that would make even the bravest soul reconsider, Mr. Bosley and his team continued their quest, issuing certificates left and right. Little did they know, the authorities were hot on their tail, leading to a showdown of epic proportions. Fast forward to courtroom battles, administrative hearings, and a rollercoaster of legal twists that could rival any Hollywood blockbuster. Will Mr. Bosley’s driving school dreams come crashing to a halt, or will he find a way to steer his way out of this legal maze? Strap in and find out!

Buckle up your seatbelts and get ready for a wild ride through the twists and turns of Bosley’s Driving School saga! Meet Mr. Bosley, the daring entrepreneur behind this driving school extravaganza, with locations in the charming towns of Donaldsonville and Gonzales, Louisiana. Now, picture this: Mr. Bosley is on a mission to teach the art of driving, but not just any driving – he dreams of offering the elusive 38-hour driver’s education course. But, oh, the drama unfolds when his dreams clash with the stern rules and regulations of the Louisiana driver’s education system. Despite a denial that would make even the bravest soul reconsider, Mr. Bosley and his team continued their quest, issuing certificates left and right. Little did they know, the authorities were hot on their tail, leading to a showdown of epic proportions. Fast forward to courtroom battles, administrative hearings, and a rollercoaster of legal twists that could rival any Hollywood blockbuster. Will Mr. Bosley’s driving school dreams come crashing to a halt, or will he find a way to steer his way out of this legal maze? Strap in and find out!

Mr. Bosley owns and runs Bosley’s Driving School for drivers’ education classes. The driving school has two locations—one in Donaldsonville and the other in Gonzales, Louisiana. The Donaldsonville location was licensed to teach 6 hours of classroom instruction, while the Gonzales location was licensed to teach the full 14-hour driver’s education course. Neither location was licensed to teach the 38-hour course. Louisiana offers two types of driver’s education courses: (1) A 14-hour course for individuals over eighteen, which requires 6 hours of classroom instruction and 8 hours of behind-the-wheel driving, and (2) a 38-hour course for individuals under eighteen, which requires 30 hours of classroom instruction and 8 hours of behind -the -wheel driving. La. R.S. 32:402. 1.

In October 2012, Bosley applied for permission to instruct the 38-hour driver’s ed course. On December 10, 2012, Bosley was notified via email that their application was denied because they needed to meet the curriculum requirements. Regardless of this denial, Bosley continued to issue certificates of completion of the 38-hour course to several students. When the State learned of this, they sent Bosley an order to cease further operations as a driving school and third-party tester in Louisiana. On March 27, 2014, the State notified Bosley that because he was providing students with the 38-hour driver’s education course despite needing to be licensed, his licenses to teach the 6-hour and the 14-hour courses were rescinded. Bosley filed an appeal and requested a hearing.

Insurance Dispute Lawyer Blog

Insurance Dispute Lawyer Blog

It is common to borrow a car from a family member or friend. If you are unfortunately involved in an accident while driving a borrowed car, who is liable for damages if the accident results from inadequate maintenance?

It is common to borrow a car from a family member or friend. If you are unfortunately involved in an accident while driving a borrowed car, who is liable for damages if the accident results from inadequate maintenance?  If you are involved in an automobile accident, it can be difficult to navigate insurance claims and coverage. The situation becomes even more complicated when there are multiple insurance policies involved. How is coverage allocated between multiple relevant insurance policies?

If you are involved in an automobile accident, it can be difficult to navigate insurance claims and coverage. The situation becomes even more complicated when there are multiple insurance policies involved. How is coverage allocated between multiple relevant insurance policies? If you are considering filing a lawsuit, it is essential that you file it in the correct venue. Otherwise, the court may lack authority to hear your claim and will not be able to consider the merits of your case.

If you are considering filing a lawsuit, it is essential that you file it in the correct venue. Otherwise, the court may lack authority to hear your claim and will not be able to consider the merits of your case.  While workers’ compensation is intended to compensate injured workers, there are a number of procedural requirements with which an injured worker must comply in order for his or her company to cover the medical treatments. This case illustrates the importance of complying with procedural requirements and submitting all required paperwork.

While workers’ compensation is intended to compensate injured workers, there are a number of procedural requirements with which an injured worker must comply in order for his or her company to cover the medical treatments. This case illustrates the importance of complying with procedural requirements and submitting all required paperwork. One frequent use of contracts is to establish how much someone will be paid for specified work. Clear contractual language can help prevent disputes down the road. What happens if you do not receive all the compensation to which you are entitled under your contract?

One frequent use of contracts is to establish how much someone will be paid for specified work. Clear contractual language can help prevent disputes down the road. What happens if you do not receive all the compensation to which you are entitled under your contract? If you are in a car accident and your insurance pays your claim, you likely expect the same thing will happen if you are subsequently in a similar accident. What happens if your insurer paid your prior claim, but tries to deny a subsequent claim?

If you are in a car accident and your insurance pays your claim, you likely expect the same thing will happen if you are subsequently in a similar accident. What happens if your insurer paid your prior claim, but tries to deny a subsequent claim?  A settlement agreement can be an efficient way of resolving a claim and receiving compensation without a lengthy trial process. However, it is essential to understand what a settlement agreement does and does not cover to avoid surprises down the road if you later try to bring related lawsuits against other parties.

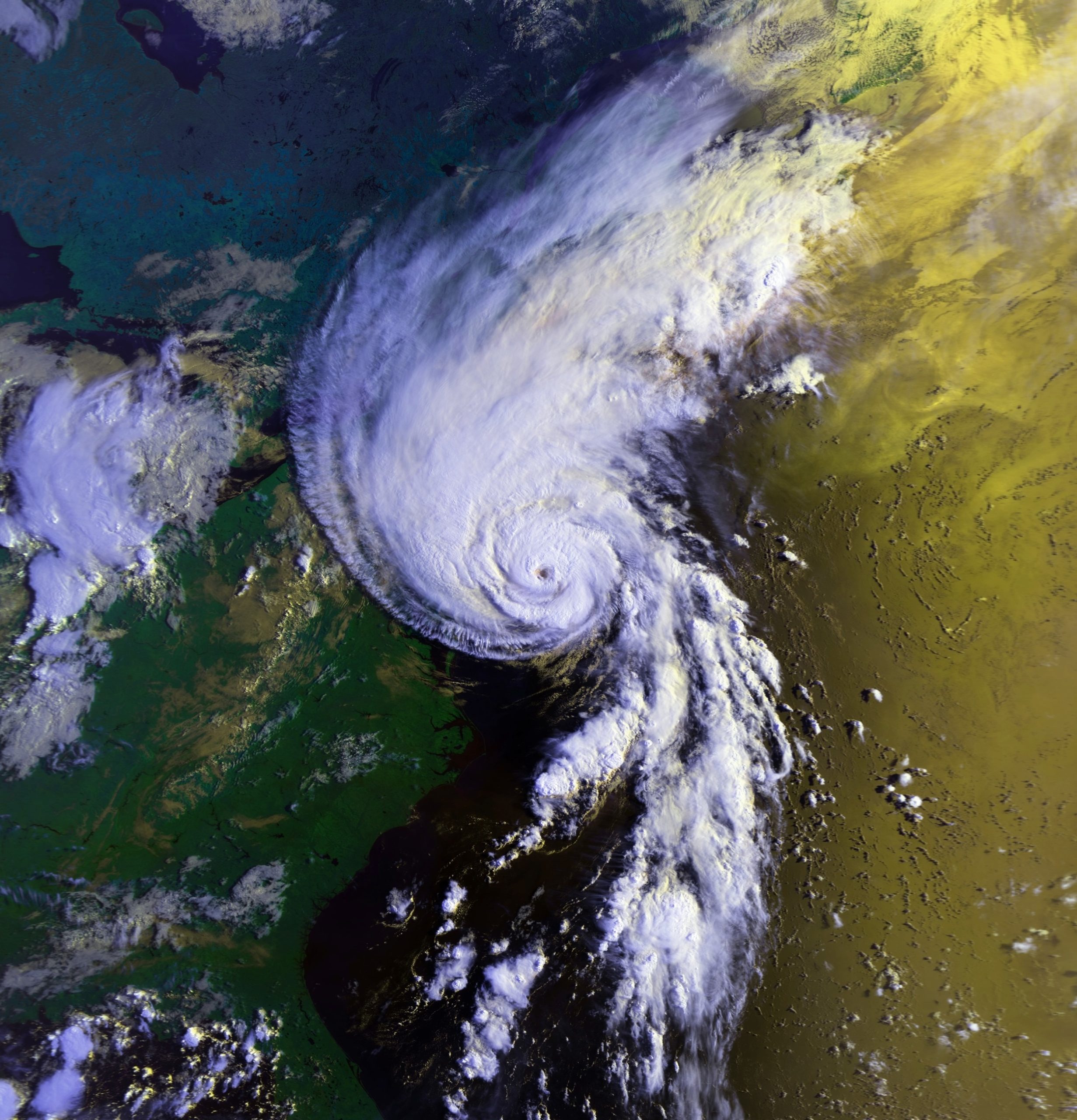

A settlement agreement can be an efficient way of resolving a claim and receiving compensation without a lengthy trial process. However, it is essential to understand what a settlement agreement does and does not cover to avoid surprises down the road if you later try to bring related lawsuits against other parties.  Over a decade after Hurricane Katrina, we have almost all heard of the difficult choices hospitals faced while trying to care for patients. This case involves a patient who was allegedly injured while being evacuated from a New Orleans hospital during Hurricane Katrina.

Over a decade after Hurricane Katrina, we have almost all heard of the difficult choices hospitals faced while trying to care for patients. This case involves a patient who was allegedly injured while being evacuated from a New Orleans hospital during Hurricane Katrina.  Under Louisiana law, there is a presumption the driver of a car that rear-ends another car acted negligently. However, this presumption of negligence can be overcome in certain situations, such as if the driver of the vehicle that was rear-end shifted lanes soon before the accident.

Under Louisiana law, there is a presumption the driver of a car that rear-ends another car acted negligently. However, this presumption of negligence can be overcome in certain situations, such as if the driver of the vehicle that was rear-end shifted lanes soon before the accident.