If you are in a car accident and your insurance pays your claim, you likely expect the same thing will happen if you are subsequently in a similar accident. What happens if your insurer paid your prior claim, but tries to deny a subsequent claim?

If you are in a car accident and your insurance pays your claim, you likely expect the same thing will happen if you are subsequently in a similar accident. What happens if your insurer paid your prior claim, but tries to deny a subsequent claim?

Brandon Forvendel was injured in a car accident. When the accident occurred, he was driving a car he owned and was insured by State Farm. Forvendel had uninsured motorist coverage. After the accident, Forvendel recovered under his uninsured motorist policy.

When the accident occurred, he was living with his mother, who also had insurance through State Farm. Forvendel also tried to recover under his mother’s uninsured motorist policy, which had higher policy limits. State Farm denied his attempt to recover under both his and his mother’s policies under the anti-stacking provisions in La. R.S. 22:1295(1)(c). Forvendel then filed a lawsuit against State Farm.

Insurance Dispute Lawyer Blog

Insurance Dispute Lawyer Blog

A settlement agreement can be an efficient way of resolving a claim and receiving compensation without a lengthy trial process. However, it is essential to understand what a settlement agreement does and does not cover to avoid surprises down the road if you later try to bring related lawsuits against other parties.

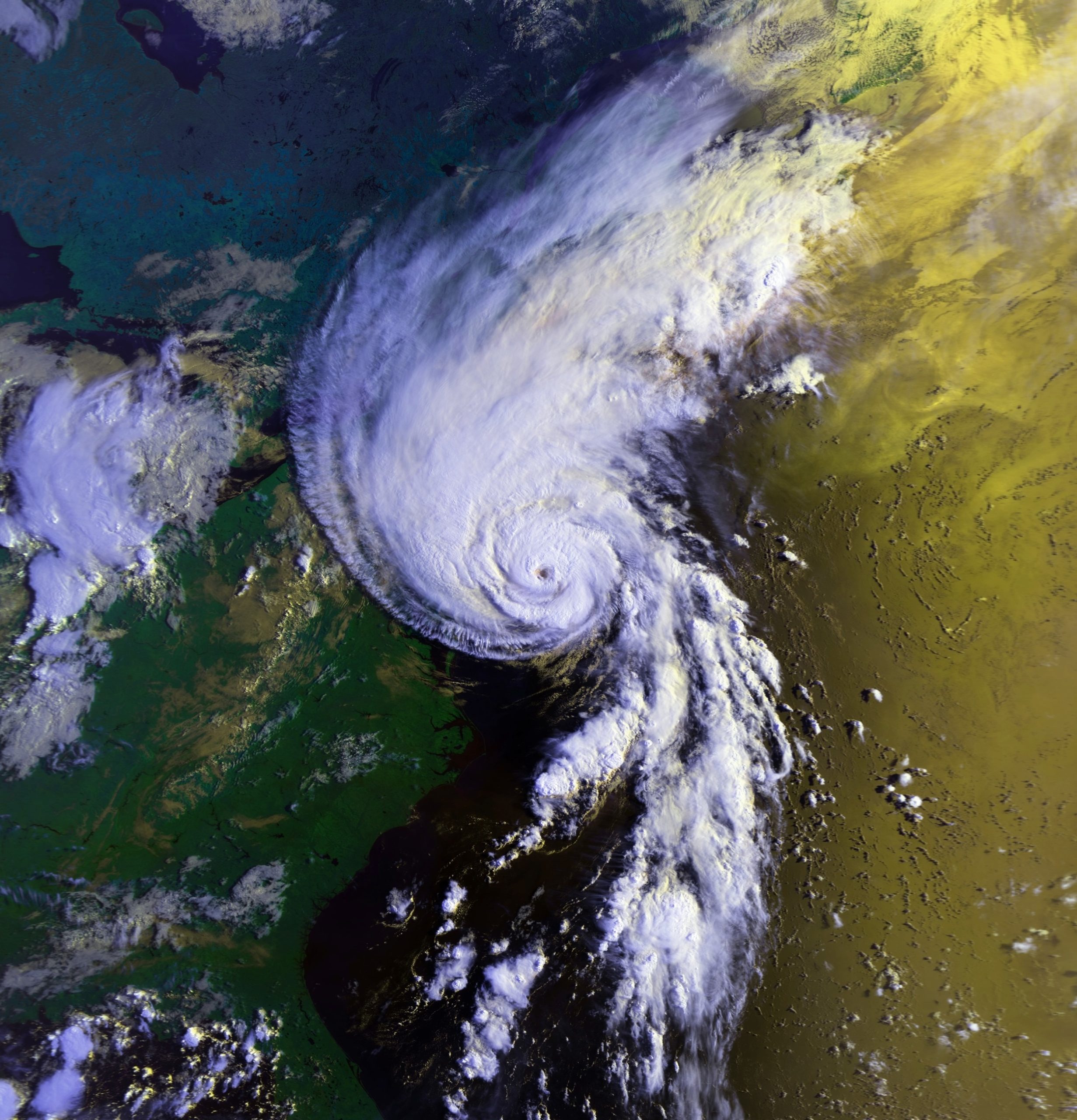

A settlement agreement can be an efficient way of resolving a claim and receiving compensation without a lengthy trial process. However, it is essential to understand what a settlement agreement does and does not cover to avoid surprises down the road if you later try to bring related lawsuits against other parties.  Over a decade after Hurricane Katrina, we have almost all heard of the difficult choices hospitals faced while trying to care for patients. This case involves a patient who was allegedly injured while being evacuated from a New Orleans hospital during Hurricane Katrina.

Over a decade after Hurricane Katrina, we have almost all heard of the difficult choices hospitals faced while trying to care for patients. This case involves a patient who was allegedly injured while being evacuated from a New Orleans hospital during Hurricane Katrina.  Dealing with the aftermath of a flood is never fun. This is especially true when the flood damages one of your vehicles. This is the situation Michael Jacobs found himself in after one of his cars was damaged in a flood. After a long fight with his insurance company, he eventually prevailed and was awarded damages.

Dealing with the aftermath of a flood is never fun. This is especially true when the flood damages one of your vehicles. This is the situation Michael Jacobs found himself in after one of his cars was damaged in a flood. After a long fight with his insurance company, he eventually prevailed and was awarded damages.  When you think about medical malpractice lawsuits, a botched surgery or missed diagnosis are likely the first things that come to mind. The following case involves a less common situation involving purported medical malpractice involving physical therapy post-surgery. It analyzes the relationship between a doctor and a physical therapist and whether a doctor can be vicariously liable for the actions of a physical therapist.

When you think about medical malpractice lawsuits, a botched surgery or missed diagnosis are likely the first things that come to mind. The following case involves a less common situation involving purported medical malpractice involving physical therapy post-surgery. It analyzes the relationship between a doctor and a physical therapist and whether a doctor can be vicariously liable for the actions of a physical therapist. It can be challenging to interpret insurance policies, especially when they involve complex provisions such as coverage for an additional insured. Before signing an insurance policy, it is imperative to understand its language and what it does and does not cover. Here, the plain language of the insurance policy proved instrumental in the appellate court’s ruling.

It can be challenging to interpret insurance policies, especially when they involve complex provisions such as coverage for an additional insured. Before signing an insurance policy, it is imperative to understand its language and what it does and does not cover. Here, the plain language of the insurance policy proved instrumental in the appellate court’s ruling. Sometimes, those delightful recreational activities we all enjoy carry an inherent risk. Often, we assume the risk of those injuries when we engage in that potentially reckless conduct. Knowing your legal options following these injuries is necessary, mainly because recovering for these somewhat ordinary injuries can be difficult. What does it look like when a party cannot recover for a recreational injury–here, an injury from a trampoline park visit?

Sometimes, those delightful recreational activities we all enjoy carry an inherent risk. Often, we assume the risk of those injuries when we engage in that potentially reckless conduct. Knowing your legal options following these injuries is necessary, mainly because recovering for these somewhat ordinary injuries can be difficult. What does it look like when a party cannot recover for a recreational injury–here, an injury from a trampoline park visit? Picture this: you’re enjoying your daily dose of local news when your name surfaces amidst a hailstorm of defamatory allegations. Your reputation takes a blow, and you decide to fight back by filing a lawsuit. This might sound like a gripping storyline from a TV courtroom drama, but for Mary R, this was a harsh reality. Today we’ll delve into her case, a fascinating battle highlighting the intriguing intersections between public figures, free speech, and defamation law.

Picture this: you’re enjoying your daily dose of local news when your name surfaces amidst a hailstorm of defamatory allegations. Your reputation takes a blow, and you decide to fight back by filing a lawsuit. This might sound like a gripping storyline from a TV courtroom drama, but for Mary R, this was a harsh reality. Today we’ll delve into her case, a fascinating battle highlighting the intriguing intersections between public figures, free speech, and defamation law. When an injury related to a product occurs, assigning fault can involve multiple parties. In personal injury litigation, crucial legal questions arise regarding whom the plaintiff can seek compensation from, if anyone, and the underlying theory of liability. The following case offers a valuable exploration of common liability theories often encountered in product-related injury cases.

When an injury related to a product occurs, assigning fault can involve multiple parties. In personal injury litigation, crucial legal questions arise regarding whom the plaintiff can seek compensation from, if anyone, and the underlying theory of liability. The following case offers a valuable exploration of common liability theories often encountered in product-related injury cases. Personal attacks often take center stage in the tumultuous arena of modern political campaigns, leaving no stone unturned and no reputation untouched. Yet, amidst this well-trodden path of character assaults, a unique legal battle emerges, where the crosshairs were not directed at a political rival but rather a candidate’s ex-spouse. In a case that blurs the lines between public discourse and private matters, the spotlight falls on the intersection of defamation claims and the exercise of free speech. Can a campaign ad’s accusations against an ex-spouse be enough to launch a successful legal battle?

Personal attacks often take center stage in the tumultuous arena of modern political campaigns, leaving no stone unturned and no reputation untouched. Yet, amidst this well-trodden path of character assaults, a unique legal battle emerges, where the crosshairs were not directed at a political rival but rather a candidate’s ex-spouse. In a case that blurs the lines between public discourse and private matters, the spotlight falls on the intersection of defamation claims and the exercise of free speech. Can a campaign ad’s accusations against an ex-spouse be enough to launch a successful legal battle?